Google, Coinbase, and Amex Unite: The New Google AI Payment Protocol (AP2) Bringing Stablecoins Into Mainstream Finance

Google’s New AI Payment Protocol: A Game-Changer for Crypto, Stablecoins, and AI Agents

In mid-September 2025 (on September 16), Google unveiled a major development that could reshape how payments happen when AI apps or “agents” transact with each other. The AI Payment Protocol innovation is being called the Agent Payments Protocol, or AP2. It is an open-source framework designed to let AI agents, software bots, assistants, apps, send and receive payments in a secure, verifiable, and standardized way. And yes, this includes support for stablecoins and traditional payment rails (credit cards, debit cards, real-time bank transfers).

This blog post will walk you through what AP2 is, who is involved, what it means for the financial / crypto world, how it works technically, and what we might expect in the coming months. I’ll try to keep the technical bits clear while still giving enough depth for crypto-savvy readers.

What Is AP2 (Agent Payments Protocol)?

Google’s Agent Payments Protocol (AP2) is an open-protocol standard that aims to enable agentic payments; that is, payments initiated by AI agents (autonomous or semi-autonomous bots) on behalf of users. These agents might do everything from shopping and booking to negotiating services and executing multi-step tasks. The protocol addresses a key challenge: how to ensure trust, authorization, clarity of intent, and accountability when a machine makes a payment decision.

Some of the core features/requirements of AP2 are:

- Payment-agnostic framework: It isn’t limited to one method; AP2 supports credit cards, debit cards, bank transfers, and stablecoins.

- Authorization / user consent: Agents must have explicit authority to act for a user. There must be cryptographic or verifiable proof that the user entrusted the agent with a specific transaction.

- Authenticity and intent: The merchant or counterparty must be able to verify that the request comes from an agent acting under the user’s instructions, not from a malicious or unintended source.

- Accountability / auditability: If something goes wrong, a fraud, wrong purchase, agent behaving badly, there must be traceable audit trails, “mandates” or contracts that lay out who is responsible.

AP2 builds on earlier protocols like Agent2Agent (A2A) and Model Context Protocol (MCP), extending them into the payments space. These earlier protocols focused more on how agents exchange information, coordinate, share context, etc. AP2 adds the financial layer.

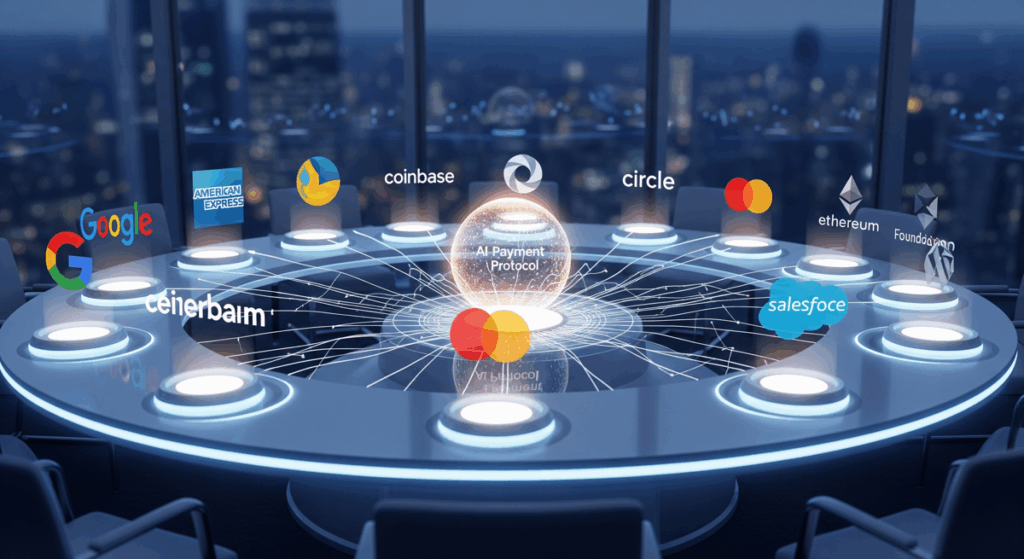

Who Is Involved: Collaboration & Strategic Partners

One striking feature of AP2 is the number and breadth of companies involved. Google did not build this in isolation. A large coalition of firms, covering both legacy finance / payment firms and crypto/blockchain players — are taking part. Some of the key names:

- Google, of course, is the orchestrator.

- Coinbase, one of the leading crypto exchanges in the US, is collaborating especially on the stablecoin rails.

- Ethereum Foundation – providing input especially around crypto / stablecoin / blockchain compatibility.

- Traditional finance / payments players: American Express, Mastercard, PayPal, Adyen, Revolut, etc.

- Merchants / commerce / tech platforms: Salesforce, Etsy, etc., and many others, more than 60 organizations in total.

In addition, Google is working with some of its existing protocols and standards: A2A, MCP. They are being extended into AP2. Also, there is mention of something called x402, which roughly functions as a micropayment / agent-to-agent payments extension. I’ll come back to that.

Stablecoins & Traditional Payments: Why Both Matter

One of the major announcements in AP2 is that it supports stablecoins (digital tokens whose value is pegged to fiat currency, typically the U.S. dollar), alongside traditional payment methods (cards, transfers). This dual support matters for several reasons:

- Payments speed and cost: Stablecoins (on well-designed blockchains) can settle quickly, often faster than bank transfers or cross-border payments, and with lower fees. For AI agents doing many small transactions (micropayments), this is critical.

- Flexibility and interoperability: Some use cases will still need traditional rails (cards, debit, etc.), especially in jurisdictions or for users who don’t use crypto. Supporting both means adoption can be broader.

- Regulatory and compliance concerns: Stablecoins are under increased scrutiny globally. But many stablecoin issuers are trying to comply with regulations. By partnering with known players (Coinbase, Ethereum Foundation) and major finance firms, Google appears to be building AP2 with an eye toward regulatory concerns.

- Enabling novel use cases: Micropayments, agent-to-agent economic flows, services that charge tiny amounts, etc. These become feasible only with payment rails that can handle small amounts reliably and cheaply. Traditional systems often struggle there. Stablecoins help fill that gap.

How AP2 Works: Key Technical & Governance Features

Beyond what AP2 is, it’s useful to understand how it works, structurally and technically. These are some of the main mechanisms and ideas that have been reported:

- Mandates & Verifiable Credentials: To authorize an agent, the user gives a “mandate,” a kind of digital contract or credential. This credential is cryptographically signed, so it can’t be forged or mis-used. This helps ensure that when an agent initiates payment, there is a traceable, user-approved mandate.

- Audit trails: Every transaction, every agent action, needs to be traceable: who asked it, what exactly the authority was, what the payment was for, etc. This matters for accountability when things go wrong.

- Agent autonomy vs supervised mode: AP2 seems designed to accommodate different levels of autonomy. A user might give full discretion to an agent within certain parameters (e.g. budget limits, trusted merchants), or might require confirmation for each purchase.

- Extensions of existing standards: The protocol uses or builds upon A2A (Agent2Agent) and MCP (Model Context Protocol) so the ecosystem stays interoperable. It also includes ‘x402’, which appears to refer to an HTTP-402 status mechanism connected with micropayments, enabling small, possibly many, transactions in a machine-friendly way.

Market Context & Why Google’s Move Is Significant

This isn’t happening in a vacuum. There are several trends and pressures in both AI and crypto/finance that make AP2 especially relevant right now.

- Rapid growth of stablecoins: Circulating stablecoins have jumped from about US$205 billion at the start of 2025 to around US$289 billion by September.

- Increasing demand for AI agents that are more autonomous: Users (and enterprises) want AI assistants that do more than fetch data or give suggestions. They want them to take actions — buy, negotiate, schedule – which often involves payments. That demand pushes the need for solid payment architecture.

- Attention on regulation and compliance: As more value moves on-chain or as stablecoins increase in usage, regulatory bodies are focusing on issues like money-laundering, consumer protection, stablecoin issuer risks, banking risks. A standard protocol that includes verifiable credentials and auditability helps address some of those concerns.

- Competition & differentiation in payments / commerce: Google is positioning itself differently from companies that try to build their own closed systems (issuing their stablecoins, or building isolated payment rails). Instead, Google seems to want to be the connector or integrator — providing the backbone or protocol that lets multiple players interoperate. This may give Google an important role in the future AI-commerce/finance landscape.

Potential Impacts: What Could Change in Finance & Crypto

Given all the above, AP2 could have wide-ranging consequences. Here are some of the possible outcomes and implications to watch out for:

- More on-chain and stablecoin settlement activity

With AI agents able to use stablecoins natively, there may be a surge in value (volume) transferred via on-chain methods. Even for small, incremental, frequent payments (micropayments), agents could move value back and forth without human involvement. - New business models / agent-to-agent commerce

Agents may become economic entities themselves: e.g., an AI agent that curates data might charge another agent for access; or an agent that handles translation might be paid per request by other agents. These models were more theoretical before; AP2 helps make them practical. - Pressure on traditional banking/payment providers

Banks and payment firms might need to adapt to these models. They will likely need to provide services that support real-time identity, authorization, and transparency for agent payments. Legacy systems may need upgrades. Regulatory pressure may force more clarity around who is responsible when something goes wrong with an AI-mediated payment. - Regulation will follow quickly

Governments and regulators will need to consider agentic payments in stablecoin/crypto context. Issues like liability, fraud, consumer protection, privacy, data rights will likely be front and center. Protocols like AP2 that build in mechanisms for audit, credentialing, verifiable mandates may help satisfy some regulatory requirements, but risk remains. - User trust and adoption will be tested

For any of this to succeed, users will need to trust that agents act only with their permission, do what they promise, and that if something goes wrong it can be fixed or reversed. UX (user experience), clarity of consent, clarity of what agents can do, transparent logs / notifications will matter. - Possibility of infrastructure bifurcation

There may be choices between blockchains / stablecoins / rails, digital vs traditional payments, varying regulatory jurisdictions. How AP2 handles interoperability, or whether different “forks” emerge, will be important. If the protocol is adopted in a fragmented way, it could lead to inefficiencies or compatibility issues.

Comparing Google’s Strategy to Other Players

It’s helpful to see how Google’s move stacks up against alternatives in the market.

- Stripe, PayPal, etc. — Some companies have been developing their own stablecoins or payment rails, or more tightly closed systems. For example, PayPal might focus on its own stablecoin or internal networks. These approaches may yield tight control, but risk being less interoperable.

- Crypto-native players — Entities like stablecoin issuers (e.g. Circle, Tether), blockchain platforms, and exchanges tend to push for open rails and composability. AP2 tends toward that philosophy, especially because it includes stablecoins and crypto partners, but remains grounded in traditional finance as well.

- Regulators / Standards bodies — Regulators will likely observe and possibly influence how AP2 is adopted, especially given its stablecoin features. Also, industry consortia (payment networks, standardization bodies) may choose to integrate or oppose aspects depending on how well they align with regulatory frameworks and risk models.

Technical & Operational Challenges

Even with all its promise, AP2 will face non-trivial challenges. As a long-time observer in the crypto / blockchain space, here are some of the barriers I expect:

- Cross-jurisdiction regulation

Stablecoins are regulated differently in different countries. What is acceptable in the U.S. (or for U.S.-issued stablecoins) may not be allowed elsewhere. Consumer protection, anti-money laundering (AML), know-your-customer (KYC) laws could complicate use in many markets. - Security and fraud risks

Enabling autonomous agents to make payments carries risk: agent impersonation, misuse of user credentials, unintended purchases. Protocols must be secure, credentials safe, and users must understand what they are consenting to. - Scalability & cost

Handling high volume of micropayments or many small transactions — will the cost of blockchain gas fees, network congestion, etc., make stablecoin rails less efficient? Some stablecoins run on “layer 2” or faster chains helps, but complexity remains. - Interoperability among blockchains / stablecoins

If different agents, merchants, developers adopt different stablecoins or blockchains, there must be compatibility or bridging. Without that, silos or inefficiencies emerge. - UX / user consent / trust issues

Even with mandates and credentials, users may feel uneasy letting agents pay without explicit confirmations. Systems will need good interfaces, clear information, controls, fallback / dispute resolution. - Regulatory scrutiny and policy risk

Governments may impose rules on stablecoin issuers, digital asset transfers, data privacy, liability. Protocol could be forced to adapt, or face bans or restrictions in some jurisdictions.

What to Watch Next

Given this development, here are things to monitor over the next 6-12 months especially in crypto / blockchain / payments / AI sectors:

- Which blockchains and stablecoins are adopted under AP2. Will it be mainly USDC, or other dollar-pegged stablecoins? Will non-USD pegged stablecoins enter? Which chain ecosystems (Ethereum, Sui, others etc.) become dominant?

- Real world pilot projects and use cases. For example, the proof-of-concept built with Lowe’s Innovation Lab demonstrates an agent planning, sourcing, checking out with stablecoin payments. If more commercial deployments show up, that will be proof of viability.

- Regulatory responses — especially in the U.S., Europe, and Asia. Will regulators impose constraints on stablecoin issuer reserves, transaction reporting, user protections in agentic payments?

- Pricing and fees: Will using stablecoins under AP2 become significantly cheaper/more efficient than current methods (cards, transfers)? How will gas fees or blockchain congestion affect that?

- Adoption by merchants / platforms: It’s not enough for tech providers / blockchains to adopt AP2; merchants, e-commerce platforms, service providers must integrate. How fast and how well that happens will shape impact.

- Security & fraud incidents (if any) in agentic payments: early bugs, misuse, or unintended behaviors may test trust. How fast are fixes, accountability, transparency?

- Competition / forks: Other companies may try to build their own agent payments protocols. How AP2’s open nature holds up under competitive pressure may matter.

Summing Up: What This Means for the Crypto & AI Landscape

Google’s AP2 marks an important moment in the convergence of AI, crypto, and finance. It is one thing to have AI agents that talk to each other, exchange data, help users; it is a bigger thing to allow them to move money – in stablecoins, cards, or transfers – under clear and secure rules. AP2’s open-source design, with multiple partners, suggests Google is betting on interoperability, not closed ecosystems.

For the crypto world, this could mean broader adoption of stablecoins in everyday commerce, not just speculative or investment use. It could mean blockchain rails become more integrated into regular software systems and services. It could accelerate competition, innovation, and change in how payments are structured under the hood.

However, success is not guaranteed. Trust, regulatory compliance, cost efficiency, and usability will determine whether this becomes a standard layer of the digital economy or another nice idea that struggles with real-world friction.