Hyperliquid: The New King of DEX Platforms – A Deep Dive into the Fastest-Growing DeFi Exchange of 2025

1.0 Introduction: The DEX Market Opportunity in the Wake of the FTX Collapse

The dramatic collapse of FTX in late 2022 left an indelible mark on the digital-asset trading ecosystem. With users’ funds held in custodial wallets and managed by the exchange, the very foundation of trust was shaken. The failure served to highlight what the industry had long known, but often underestimated: custodial platforms carry systemic risks, including mis-management, fraud, and opaque operations.

In the aftermath, a powerful shift in trader and investor behaviour emerged. There was a growing demand for non-custodial trading venues – platforms where users retain control of their assets and where trading is settled “on-chain”. More specifically, this sentiment reached deep into the derivatives markets: traders sought venues offering the responsiveness and features of major centralized exchanges (CEXs), but with the transparency and self-custody of decentralized exchanges (DEXs).

It is precisely in this landscape that Hyperliquid was conceived: to fill the gap between the usability of a CEX and the structural integrity of a DEX. In simpler terms, traders wanted the slick interface, speed, and low latency of a CEX, but they also wanted to avoid the risk of handing over custody of their funds. Hyperliquid set out to deliver a non-custodial, on-chain settlement platform built for derivatives. The strategic opportunity is clear: by addressing the fundamental UX vs. decentralization trade-off, Hyperliquid aimed to carve out a large niche in the post-FTX era.

2.0 Hyperliquid’s Core Value Proposition: Resolving the UX vs. Decentralization Dilemma

The most compelling narrative in Hyperliquid’s story is its attempt to resolve the age-old conflict in DeFi: user experience versus true decentralization. Many DEXs have sacrificed on either front; some get decentralization right but are slow and clunky, others mimic CEX UI & UX but require more trust. Hyperliquid claims to bridge this divide through some bold engineering choices and architectural trade-offs. Below is a breakdown of how it accomplishes that.

2.1 The Order Book Model: A Tool for Professional Traders

One of the major differentiators is Hyperliquid’s use of a native order-book model, rather than the Automated Market Maker (AMM) model that dominates most decentralised platforms (for example, Uniswap, etc.). The AMM model was transformational: it allowed token swaps without traditional counterparties, but it comes with significant limitations when it comes to professional trading needs:

- With an AMM you often cannot specify a precise entry or exit price (i.e., a limit order) in the same way a professional trader expects.

- Slippage and price impact are higher when liquidity pools are thin and a large trade moves the price.

- For leveraged positions, even a 1% deviation from expected price may translate into much greater risk or even ruin.

Hyperliquid’s design, by using a full order book, enables traders to place limit orders at a specified price and guarantee execution (or better) at that price, essentially eliminating slippage risk inherent to AMMs. For example: imagine a trader wants to buy Bitcoin at $78,000 with leveraged positions, if using an AMM and the pool is shallow, the trade might drive the price up to $80,500. That difference in a leveraged position could be catastrophic. With an order-book, the trader obtains control. That’s the strategic advantage for serious traders.

2.2 Bespoke Layer 1 Architecture: The Engine for High Performance

To deliver a seamless, low-latency, high-throughput order-book experience entirely on-chain, Hyperliquid made a significant strategic choice: it built its own proprietary Layer 1 blockchain, rather than piggybacking on an existing network. Why is this important?

- Many existing blockchains (even advanced ones) face limitations around transaction speed, gas costs, latency, and scalability when supporting high-frequency trading.

- For an order-book with thousands of placements, cancellations, and matches every second, a standard blockchain might be too slow or costly.

- Hyperliquid’s L1 implements its custom consensus mechanism (called HyperBFT) and claims very high performance: in its marketing, figures like 100,000–200,000 transactions per second (TPS) are referenced.

By comparison, chains like Solana, though high-performing, operate in a different environment. For example, Solana’s peak recorded block reached over 100,000 TPS in a stress test, but real-world sustained throughput remains far lower.

What this bespoke L1 approach gives Hyperliquid users is near-instant order execution, zero gas fees for trading, and an experience that mimics a top-tier CEX while settlement remains on-chain. The claim is: you retain custody, you get transparency, and you don’t sacrifice latency or usability.

2.3 The HLP Vault: A Decentralized Approach to Liquidity

Another pillar of Hyperliquid’s design is its liquidity mechanism: the HLP (Hyperliquid Vault). Instead of relying on traditional market-makers alone, Hyperliquid opens up liquidity provision to the platform’s users:

- Users deposit assets (e.g., USDC) into the HLP vault.

- The vault collectively acts as the counter-party for trades on the platform, providing liquidity to the order book.

- Deposit‐providers (LPs) receive returns from two main sources: (1) trading fees (from all trades executed), and (2) liquidation profits (when leveraged positions are liquidated, HLP acquires assets at a discount and sells them, capturing the spread).

By distributing these traditional market-making functions to users, Hyperliquid aims to democratise liquidity provision and deepen book depth, critical for professional traders. It also aligns incentives: those providing liquidity stand to gain from trading and liquidations.

2.4 Strategic Compromise: Off-Chain Matching for a CEX-Grade UX

Despite the ambition to be “fully on-chain”, Hyperliquid acknowledges a strategic compromise: the matching engine, the order‐book engine that pairs buy/sell orders, is off-chain (i.e., traditional server infrastructure), while fund custody and settlement occur on-chain. In other words:

- Orders are matched off-chain for speed and performance.

- Once trades are matched, settlement is posted on-chain, funds remain non-custodial until settlement.

- This gives end-users the low latency and usability of a CEX, with the self-custody and on-chain transparency of a DEX.

This hybrid model is the source of Hyperliquid’s claim to product-market-fit so early, but also its core strategic tension. By moving some matching off-chain, it introduces a degree of centralisation and trust (in the matching server) that purist decentralisation advocates will criticise. It is a trade-off: excellent UX at the cost of some decentralisation purity.

3.0 Competitive Landscape and Market Performance

Having covered how Hyperliquid is built and what it offers, it’s important to put it into context: how does it compare with other derivatives-DEX players and what metrics demonstrate its position?

3.1 Quantitative Benchmarking Against Rivals (as of October 2025)

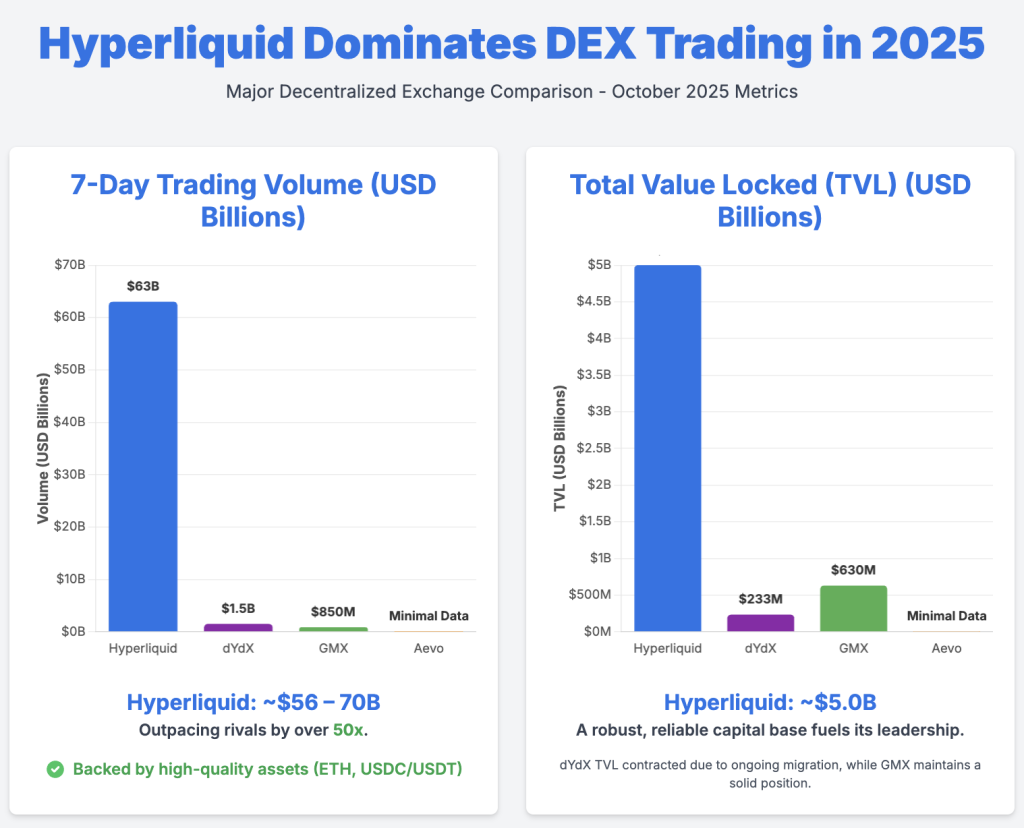

As of October 2025, Hyperliquid continues to maintain a commanding lead over other decentralized perpetual trading platforms, both in terms of trading volume and total value locked (TVL). The updated data below reflects its dominant position within the on-chain derivatives ecosystem:

| Platform | 7-Day Trading Volume (Approx.) | TVL (Total Value Locked) |

|---|---|---|

| Hyperliquid | US$ 56 – 70 billion | US$ ≈ 5.0 billion |

| dYdX | US$ ≈ 1.5 billion | US$ ≈ 232.9 million |

| GMX | US$ ≈ 0.7 – 1.0 billion | US$ ≈ 630 million |

| Aevo | US$ ≈ 29.54 million | US$ ≈ 57.1 million |

Sources: Phemex Research (Oct 2025), DefiLlama, NFTEvening, and other aggregated DEX analytics.

These latest figures highlight how Hyperliquid’s market presence has expanded dramatically in 2025. With a weekly trading volume exceeding US$ 60 billion and a TVL surpassing US$ 5 billion, Hyperliquid’s scale now outpaces its closest competitors by multiple factors.

In contrast, dYdX’s TVL has contracted to roughly US$ 230 million, reflecting the platform’s ongoing migration and evolving architecture, while GMX maintains a solid mid-range position with around US$ 630 million in TVL.

Notably, Hyperliquid’s liquidity is backed by high-quality assets such as ETH and stablecoins (USDC/USDT), not inflated native tokens, giving its capital base a higher degree of reliability and real market depth. This composition strengthens its credibility and reinforces its leadership in the decentralized perpetuals sector.

3.2 Strategic Differentiation: The “Endgame Model”

What stands out is Hyperliquid’s claim to an architecture that may represent the future of on-chain derivatives trading: combining a full order-book, high throughput L1, and non-custodial settlement. Other platforms follow different models:

- dYdX: off-chain order book, on-chain settlement (on a secondary chain).

- GMX: AMM-based model (liquidity pools) rather than order book.

Hyperliquid posits: this is the “endgame model” – the first to show that a DEX can rival a CEX in performance and features without sacrificing self-custody. That claim alone is powerful in a post-FTX trust environment, where professional traders are wary of custodial risk.

3.3 The “On-Chain FTX/Binance” Vision

Hyperliquid’s strategic vision goes beyond being “just another DEX”. By controlling both a high-performance L1 and a derivatives platform, it mirrors the playbook of large integrated platforms like FTX on Solana, or Binance with Binance Chain/BSC. The idea:

- The exchange (application layer) drives massive user-volume and fee-generation.

- Those fee-flows drive demand for the underlying L1’s blockspace and token.

- As the ecosystem grows, other applications are attracted to the L1, thus creating a self-reinforcing economic flywheel – a genuine moat.

In effect, Hyperliquid isn’t just a DEX, it seeks to become a full-stack financial ecosystem. That kind of ambition appeals to investors, builders, and traders alike, but also raises the stakes and complexity of execution.

4.0 Analysis of Growth Drivers and Go-to-Market Strategy

How did Hyperliquid climb so quickly? What levers did it pull to go from concept to market leader? Let’s explore.

4.1 Founder Expertise and Self-Funding Model

A key factor is the founding team: they come from a top-15 global high-frequency trading (HFT) platform. This craft background matters for several reasons:

- They understand the exacting requirements of professional traders: low latency, deep liquidity, APIs, execution precision.

- They are less influenced by typical DeFi hype cycles or VC demands for short-term gains.

- Importantly, Hyperliquid was self-funded, no VC money. This means the team had autonomy, could prioritise product first (not investor pressure), and focus on building what users needed rather than what investors demanded.

That hard-core trading mindset gave Hyperliquid an operational and product edge early on, a rare asset in DeFi.

4.2 Product-Led Organic Growth

Another success driver was growth through product, not marketing. Hyperliquid achieved traction via the strength of its interface, performance, and liquidity rather than via token hype, aggressive community giveaways, or short-term promotions. Traders came because they found the product compelling; they stayed because they found the engine reliable. The result: strong word-of-mouth, organic user growth, and a reputation for serious trading.

4.3 Airdrop as a Network Catalyst

That said, Hyperliquid did employ token incentives, critically, but in a tactical, not purely gimmick-driven way. Roughly 31% of the total token supply was allocated to early users via a sizeable airdrop. This served as a catalyst: it amplified network effects, incentivised early adoption, and rewarded users who helped bootstrap liquidity and trading. But the key is: the core growth remained product-driven, not solely token-hype-driven.

5.0 Key Risks and Headwinds

Even with strong growth, a balanced analysis demands a focus on the risks. Hyperliquid’s rapid rise is built on trade-offs which carry exposure.

5.1 Centralization and Transparency Concerns

From the decentralisation purist’s standpoint, Hyperliquid’s architecture raises legitimacy questions:

- Validator Concentration: At launch, the network ran only 4, later 16 validators – suspected to be controlled by the core team.

- Token Staking Centralisation: The foundation nodes reportedly control ~80% of staked tokens, creating outsized influence in governance and operations.

- Closed-Source Code: The core codebase remains closed-source, preventing third-party audits and community verification of security and logic.

- Single Client Implementation: Reliance on one client means a single bug or exploit could compromise the network; resilience through multiple implementations is absent.

These factors deepen the trust-assumption burden on users. The paradox is: a platform built to offer decentralised trust still retains trust-requirements (in the team, code, nodes) because of architectural decisions. For some traders, that may be acceptable, but for others, it may represent a structural risk.

5.2 Regulatory and Market Risks

Beyond architecture, there are significant external headwinds:

- Regulatory Scrutiny: Perpetual futures and leveraged trading are under increasing regulatory scrutiny globally. The appeal of “no-KYC, non-custodial” may face friction if regulators push mandatory identity requirements or tighten rules around derivatives.

- Token Unlock Pressure: Hyperliquid’s tokenomics include a large locked supply (≈60%). A major unlock schedule – starting contributor unlocks (24-month linear) as of Nov 29, may translate into monthly sell pressure (≈450 million tokens) that could far exceed buy-back volumes (~110 million in August). This supply-side tension could impact token valuation and sentiment.

6.0 Conclusion and Future Outlook

In the span of just a few years, Hyperliquid has engineered a system that many in DeFi considered almost impossible: a derivatives DEX with CEX-grade speed, deep liquidity, zero gas fees and on-chain settlement. It answered the post-FTX demand for a performant and transparent non-custodial platform, and captured early market share accordingly.

Yet today the focus shifts from what it has achieved to what it must deliver next. The central question: will Hyperliquid successfully transition from its current hybrid, semi-centralised state to a fully decentralised, sustainable model before token unlocks and regulatory pressures undermine its momentum?

Key milestones ahead include:

- Expanding validator decentralisation, open-sourcing core code, spawning multiple client implementations to reduce single-point risks.

- Continuing to manage token-unlock drag, implementing meaningful buy-back or burn mechanisms, and communicating transparently to the market.

- Launching the promised EVM-compatible layer (“HyperEVM”) and growing an ecosystem of applications beyond the exchange itself to build the network flywheel.

- Monitoring regulatory developments in derivatives trading and no-KYC platforms and adapting proactively to compliance requirements without losing the core trust virtue of the platform.

If Hyperliquid can execute on those fronts, the payoff is significant: it could well cement the “on-chain FTX/Binance” vision and become a foundational layer in the next generation of DeFi infrastructure. For traders and investors, the ascendancy of Hyperliquid is a story not just of platform choice—but of architecture, trust, execution and timing.

In short: Hyperliquid has already defined the promise; it now must fulfil the performance, decentralisation and economic sustainability to justify that promise.

Incorporating a Look at Solana for Context

As we evaluate Hyperliquid’s architecture and its competitive positioning, it is useful to compare it with a leading high-throughput Layer 1 chain like Solana. Solana’s performance and ecosystem illustrate what is possible, and also the gaps that still exist in on-chain derivatives trading. Check out this deep-dive article about Solana.

- Solana recorded a block that processed 107,664 TPS in a stress scenario in August 2025, marking a major milestone in throughput.

- However, those peak numbers were achieved with “no-op” transactions (i.e., lightweight operations that don’t change state). Real-world, meaningful transaction throughput for Solana remains in the 1,000-3,700 TPS range.

- The average fees on Solana remain extremely low (less than $0.00025 in some cases), and infrastructure improvements continue.

- At the same time, Solana’s decentralisation metrics and validator health remain strong, but the architecture still faces questions around state-bloat, MEV, spam attacks, and meme-coin-induced congestion.

What this comparison tells us in the context of Hyperliquid:

- Even a high-performing L1 like Solana still has non-trivial gaps (in real-world throughput, decentralisation vs. spam resilience, ecosystem maturity) when assessed on trading-engine requirements.

- Hyperliquid’s decision to build a purpose-built L1 and a bespoke architecture can therefore be viewed as a response to those gaps: rather than rely on a general-purpose L1, build a specialised engine for professional trading.

- But the trade-off is clear: by focusing on speed and CEX-styling, Hyperliquid accepts a degree of centralisation and trust. Solana’s advantage is broader decentralisation and ecosystem reach—but may sacrifice the specialised optimisation for derivatives order-books.

Thus, Hyperliquid’s positioning makes sense: it recognises that not all chains are optimised for professional trading, and that by tailoring architecture and matching engine it can create a differentiated offering. But as we discussed, the execution risk is real: decentralising the network, managing tokenomics, and navigating regulation will determine whether its promise is realised.

Final Thoughts for Investors and Traders

For investors, especially those with exposure to the derivatives and infrastructure side of crypto, Hyperliquid offers both an intriguing opportunity and a cautionary case.

Opportunity side:

- If you believe that derivatives trading will continue to shift from centralised to decentralised venues, platforms like Hyperliquid are well-positioned to capture that flow.

- The combination of order-book, zero gas fees, deep liquidity, and non-custodial settlement aligns with what professional traders want, once the trust concerns are managed.

- The potential of a “network flywheel” (exchange → chain → ecosystem) is massive.

Risk side:

- The centralisation concerns are not academic, they impact security, governance, resilience, and ultimately user trust.

- Token unlocks and supply pressure are real risks to valuation and market perception.

- Regulatory risk in derivatives is non-trivial, especially in jurisdictions moving to regulate perpetuals, leverage, KYC/AML.

- Execution risk: vision is one thing, delivery is another. The promised HyperEVM and ecosystem build-out need to happen.

In summary: Hyperliquid is one of the boldest infrastructure plays in crypto derivatives today. It targets a large problem (derivatives DEX UX vs decentralisation) with a sophisticated architecture. Its early traction validates the concept. But now its fate depends on whether it can scale safely, decentralise credibly, and operate compliantly. That’s where the next phase of its journey, and yours as a reader/investor: begins.

Disclosure: This article is for educational purposes only and not investment advice. Crypto derivatives and infrastructure tokens carry significant risk. Do your own research and consider regulatory and personal risk factors.