SoundHound (SOUN): The Next Palantir? Unlocking a Rare AI Niche with Massive Upside

SoundHound AI: Orchestrating the Future of Human-Machine Interaction with Conversational Intelligence

In the dynamic tapestry of artificial intelligence, where innovation is the only constant, SoundHound AI (NASDAQ: SOUN) has carved out a distinctive and increasingly influential niche. From its humble origins as a consumer-facing music identification application, the company has masterfully orchestrated a strategic pivot, transforming into a formidable provider of conversational AI for business solutions. With two decades of experience observing the ebbs and flows of the AI industry, I can attest that SoundHound’s journey is a compelling case study in technological foresight, adaptable strategy, and the relentless pursuit of seamless human-machine interaction.

SoundHound AI’s current standing is built on a proprietary foundation designed to transcend the limitations of conventional voice assistants. Its core mission is to enable businesses to deliver intuitive, voice-activated experiences across a vast spectrum of products and services, mirroring the sophistication of human perception in understanding and interpreting sound. This cornerstone article delves into SoundHound’s technological prowess, its strategic market penetration, financial trajectory, and the nuanced competitive landscape it navigates, providing a comprehensive analysis for discerning financial and investment readers.

The Evolution: From Midomi to a Voice AI Powerhouse

SoundHound AI’s narrative began in 2005 as Melodis Corporation, co-founded by Keyvan Mohajer, James Hom, and Majid Emami. Their inaugural product, Midomi, launched in 2007, was a music identification tool that stood out due to its unique ability to identify songs from vocal input – a user could hum or sing a tune, a stark differentiator from its contemporaries like Shazam. This early emphasis on sophisticated sound recognition through vocalization was a clear precursor to SoundHound’s future as a leader in voice AI. Rebranded as the SoundHound app in 2009, it rapidly gained consumer traction, boasting over 300 million users by 2016, and even venturing into wearable technology in 2014.

However, the true strategic inflection point arrived in 2015 with the introduction of Houndify, SoundHound’s proprietary voice AI platform. This marked a fundamental shift from a consumer app model to a robust business-to-business (B2B) enterprise provider. The vision was clear: empower other enterprises to seamlessly integrate advanced voice AI into their own offerings. Houndify was underpinned by SoundHound’s proprietary Speech-to-Meaning® and Deep Meaning Understanding® technologies, which directly interpret spoken language into meaning, bypassing the traditional two-step process of speech-to-text conversion followed by text-to-meaning interpretation. This architectural difference significantly boosts speed and accuracy, delivering real-time, contextually aware responses crucial for demanding applications like in-car systems or drive-thru ordering.

The company’s growth trajectory has been punctuated by significant financial milestones and strategic realignments. SoundHound achieved “unicorn” status in 2017 with a $75 million funding round, followed by another $100 million in 2018 from prominent investors such as Nvidia, Samsung, and Tencent. Its public debut on Nasdaq in April 2022, following a SPAC merger, valued the company at $2.1 billion, raising $111 million. While subsequent workforce reductions in late 2022 and early 2023 highlighted a necessary operational streamlining amidst economic shifts, continued investor confidence was demonstrated by a $100 million strategic financing round in April 2023.

A series of calculated acquisitions in 2023 and 2024 have been pivotal in SoundHound’s aggressive expansion strategy. The acquisition of SYNQ3 Restaurant Solutions in December 2023 instantly made SoundHound the largest voice AI provider for restaurants. This was quickly followed by Allset, a restaurant ordering marketplace, in June 2024, further solidifying its voice commerce ecosystem.

Most significantly, the $85 million acquisition of Amelia AI in August 2024 broadened SoundHound’s reach into critical new verticals such as finance, insurance, and healthcare, powering its ambitious “AI Agents for enterprise” offerings. These acquisitions are not merely revenue-generating; they are strategic moves to rapidly expand SoundHound’s serviceable market and accelerate its vision of “Agentic AI.”

The Technological Edge: SoundHound’s AI Stack Unpacked

SoundHound AI’s competitive differentiation is inextricably linked to its sophisticated and highly proprietary AI stack. This technological depth enables it to offer solutions that consistently outperform many rivals in speed, accuracy, and contextual comprehension.

Proprietary Technologies at the Core: As mentioned, the cornerstone of SoundHound’s advantage lies in its Speech-to-Meaning® and Deep Meaning Understanding® technologies. By directly interpreting speech into meaning, the system sidesteps the latency and potential errors inherent in traditional ASR-to-NLU pipelines. This unique single-function processing is a significant factor in delivering instantaneous and precise responses, which are paramount in hands-free environments.

Adding another layer of sophistication is Query Glue® Technology. This innovation allows SoundHound’s AI to seamlessly connect disparate knowledge domains, enabling it to process and respond accurately to complex, multi-faceted queries. Imagine asking a voice assistant, “Show me all French restaurants near the Eiffel Tower that are open past 10 PM on a Sunday and have outdoor seating, but exclude any with less than 4 stars.” Query Glue® is the engine that can synthesize these distinct pieces of information from various databases to provide a coherent and accurate answer, demonstrating a highly nuanced understanding of user intent.

Robust ASR Capabilities: SoundHound’s Automatic Speech Recognition (ASR) system is built on an optimized, tunable, and scalable neural network architecture. It supports vocabulary sizes running into millions of words and is trained using extensive real-world data, accounting for diverse acoustic conditions, speaker variations, and application contexts. This deep learning approach leads to superior accuracy in acoustic modeling. Its integration with NLU components further enhances sentence accuracy and contextual understanding, while extensive customization capabilities allow for dynamic augmentation with domain-specific lexicons and grammars, critical for specialized enterprise applications.

A key strength for SoundHound’s global ambitions is its comprehensive multilingual support. The platform currently supports 25 of the world’s most popular languages, with more on the horizon. Crucially, its acoustic models are trained with robust data from both native and second-language speakers, including distinct regional models for specific accents. This ensures high accuracy for accented language, a vital feature for multinational enterprise adoption, setting SoundHound apart from platforms with less robust global capabilities, particularly in customer service.

Furthermore, SoundHound’s ASR technology offers flexible edge connectivity solutions, providing clients with options for fully-embedded, hybrid, or exclusively cloud-connected deployments. This allows for optimization based on NLU requirements, CPU processing power, and critical privacy needs. The end-to-end Voice AI tech stack also includes custom vocabulary, custom pronunciation, SSL security, confidence scores, timestamp generation, speaker identification, real-time streaming, and at-rest encryption, emphasizing a secure and comprehensive offering.

The Houndify Platform and Collective AI®: Houndify serves as SoundHound’s developer platform, providing access to APIs, endpoints, documentation, and SDKs across various programming languages and platforms. This platform-centric approach fosters a developer ecosystem, crucial for widespread adoption. A standout innovation here is Collective AI®, a crowd-sourced architecture that allows developers to extend existing AI domains without needing to delve into their underlying complexities. This collaborative model creates a continuously learning knowledge base, where contributions enhance the overall intelligence and value of the system, potentially creating powerful network effects and a self-reinforcing competitive advantage.

Pioneering Generative AI and Agentic AI: SoundHound is not just keeping pace with the latest AI advancements; it is actively shaping the future of conversational AI through the integration of generative AI. By leveraging cutting-edge large language models (LLMs), SoundHound Chat AI provides more knowledgeable, in-depth, and human-like interactions, moving beyond predefined responses. The company notes strong adoption and significant reductions in inference costs, enabling efficient scaling.

Perhaps most significantly, SoundHound is an early innovator in voice-first AI agents, a concept gaining considerable momentum. These AI Agent Enterprise Applications are designed to operate autonomously, capable of setting goals, making decisions, retrieving knowledge, and completing complex tasks with minimal human intervention. SoundHound highlights its active deployment of these agentic AI solutions in real-world scenarios, differentiating itself from competitors who may still be in the theoretical or developmental stages. Key products demonstrating this include Autonomics (an AIOps platform), the consumer-facing SoundHound Chat AI app, and the Amelia Platform, specifically engineered to power AI Agents for enterprise clients.

The company’s proprietary Polaris model, a multimodal and multilingual foundation model, further underscores its technological lead. It boasts superior performance, with average latency up to four times better than competitors and significantly higher accuracy, including approximately twice the sentence accuracy in noisy environments and a 35% better word error rate. Its maturity across nearly 30 languages removes barriers to international expansion, especially for customer service solutions. If Agentic AI proves to be the next major wave of AI adoption, SoundHound’s early focus and product development could provide a significant first-mover advantage, positioning it to capture a substantial share of the projected $139 billion agentic AI market by 2033.

Industry Solutions and Strategic Partnerships: Expanding Reach

SoundHound AI has strategically deployed its advanced voice and conversational AI across several high-growth industries, solidifying its market footprint through key partnerships.

Automotive: The automotive sector is a foundational pillar for SoundHound. Its in-car voice assistants enable natural conversations for navigation, climate control, and increasingly, voice commerce. The integration of generative AI allows for highly fluid, context-aware interactions, remembering previous commands and adapting to user preferences. Voice commerce in vehicles, allowing drivers to place orders and make payments hands-free, is a groundbreaking feature projected to unlock a substantial $63 billion in potential industry revenue. SoundHound’s commitment to safety is evident in its focus on hands-free convenience, minimizing driver distraction.

The company boasts an impressive roster of automotive partners, including Hyundai, Alfa Romeo, Citroën, Lancia, Stellantis (across six brands), Lucid Motors (notably replacing Amazon Alexa for EV-specific context), and Togg. A significant technological partnership with NVIDIA integrates SoundHound’s generative AI voice assistant on NVIDIA Drive AGX™ platforms. While the automotive sector is a strong growth driver, it carries inherent risks due to its cyclical nature and economic sensitivity, a factor SoundHound’s diversification strategy aims to mitigate.

Restaurants: SoundHound AI has honed its voice AI for the restaurant industry, offering Dynamic Drive-Thru and Smart Ordering solutions. These AI-powered systems improve customer experience, reduce operational costs, and boost revenue. With active solutions in over 13,000 locations, and having processed over 100 million interactions by October 2024 (including over $100 million in annual restaurant orders), SoundHound has demonstrated significant scale. Major U.S. pizza chains, Applebee’s, and White Castle are among its growing list of partners.

Enterprise Solutions: SoundHound provides tailored AI-powered solutions across diverse enterprise needs:

- Financial Services: AI agents transform customer and employee interactions, offering immediate answers, resolving problems, and automating tasks. SoundHound serves 70% of the top 10 global banks, including BNP Paribas, automating customer service calls.

- Healthcare: AI agents guide patients through their care journeys, from initial contact to follow-up and education, enhancing outcomes. Contracts with prominent providers like Duke Health and Wellstar Health System underline its impact.

- Retail: Scalable AI agents provide consistent voice AI experiences for multi-location retail and franchise businesses.

- IT Operations (AIOps): The Autonomics platform, a generative AI-enabled AIOps solution, streamlines IT processes, reducing downtime and optimizing existing technology stacks. It was recognized as a market leader by ISG Research in 2025.

- Employee Assist: Provides real-time information and support to staff for technical and operational queries.

Voice Commerce: The Monetization Flywheel: Voice commerce represents a significant strategic growth engine for SoundHound AI. This technology seamlessly integrates ordering, payments, loyalty programs, and navigation into voice assistants, creating a hands-free experience. Consumer demand is robust: nearly 80% of U.S. drivers prefer in-car voice ordering over traditional drive-thrus, and 84% of pre-order app users would opt for voice commerce if available. This clear market appetite positions SoundHound to unlock substantial transactional revenue. By facilitating new business models for its clients, SoundHound is creating a “monetization flywheel,” where increased voice AI adoption drives transaction volume and, in turn, higher revenue for SoundHound, deepening its value proposition beyond mere software sales.

Market Landscape and Competitive Dynamics: Navigating a Growing Arena

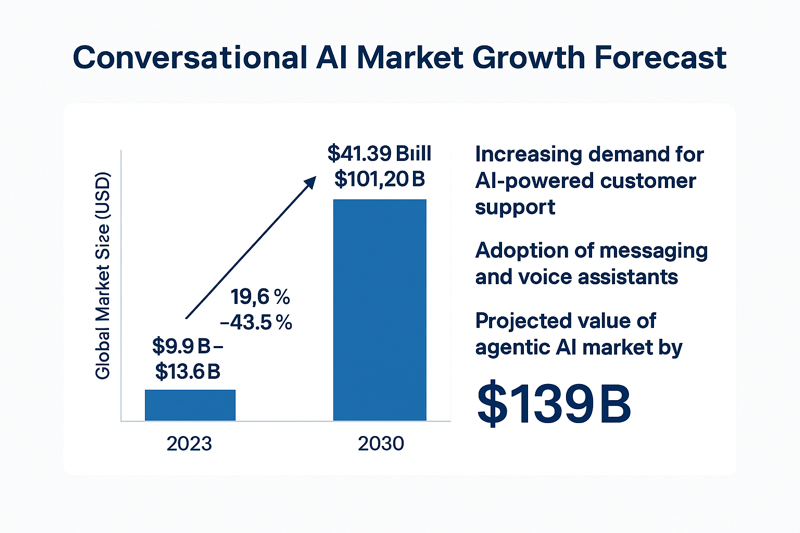

SoundHound AI operates within a rapidly expanding and intensely competitive conversational AI market. Various research firms project robust growth, with the global market valued between USD 9.9 billion and USD 13.6 billion in 2023, and anticipated to reach figures between USD 41.39 billion and USD 101.20 billion by 2030, with CAGRs ranging from 19.6% to 43.50%. This growth is primarily driven by escalating demand for AI-powered customer support, widespread adoption of messaging and voice assistants, emphasis on omnichannel engagement, and continuous advancements in NLP and ML. SoundHound specifically aims to dominate the burgeoning agentic AI market, projected to reach $139 billion by 2033.

SoundHound’s primary competitive advantages stem from its proprietary Speech-to-Meaning® and Deep Meaning Understanding® technologies, which offer superior speed and accuracy by directly interpreting meaning. Its Query Glue® Technology further enhances contextual understanding for complex queries. The robust, customizable, and multilingual ASR system, coupled with flexible deployment options, provides a distinct edge, especially for global enterprise clients. The Houndify platform and its Collective AI® approach foster a valuable developer ecosystem, and the early adoption and deployment of voice-first generative AI and agentic AI solutions, exemplified by the Polaris model’s superior performance metrics, position SoundHound as a potential first-mover in this next wave of AI.

However, the competitive landscape is fierce. SoundHound competes not only with well-capitalized tech giants like Amazon (Alexa), Google (Assistant), Apple (Siri), and Microsoft (Cortana), but also with specialized conversational AI firms, contact center solution providers, and in-house development efforts by large enterprises. SoundHound’s ability to differentiate through its unique technology, focus on specific verticals, and deliver tangible ROI for its clients will be critical for sustained market leadership.

Financial Performance and Investment Outlook: Balancing Growth and Profitability

SoundHound AI has demonstrated impressive top-line growth. In Q1 2025, revenue surged by 151% year-over-year to $29.1 million, and full fiscal year 2024 revenue reached $84.7 million, an 85% increase. This growth is significantly bolstered by its strategic acquisitions. The company’s revenue backlog, which stood at approximately $1.2 billion at the end of 2024, signals strong future revenue potential from signed contracts.

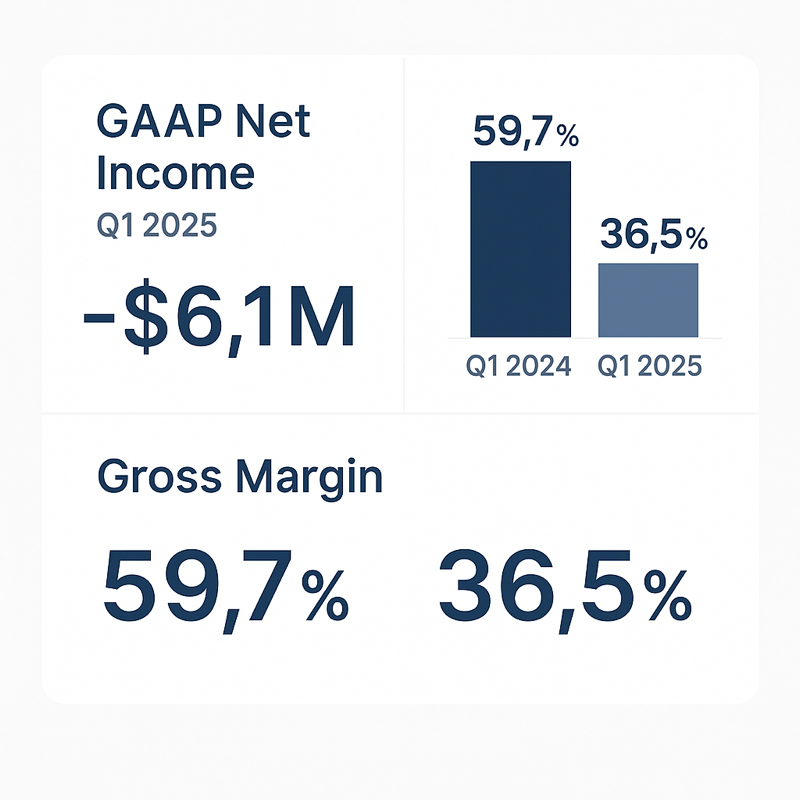

Despite rapid revenue growth, SoundHound AI has consistently faced challenges with profitability. The company has exhibited persistent unprofitability, with Q1 2025’s GAAP net income primarily driven by a non-cash benefit from contingent acquisition liabilities, rather than core operational profitability. Gross margins have also faced pressure from acquisitions, notably declining from 59.7% in Q1 2024 to 36.5% in Q1 2025, largely due to the inherently lower margins of acquired businesses like Amelia and SYNQ3. This highlights a strategic trade-off: rapid market expansion through acquisition comes at the cost of immediate margin compression.

SoundHound’s valuation, marked by a high price-to-sales (P/S) ratio (ranging from 31x to 38.6x), suggests a speculative premium based on aggressive future growth expectations rather than current profitability. Investors must closely monitor the successful integration of acquired entities and the company’s progress toward achieving sustainable operational profitability, rather than solely focusing on top-line growth or one-time accounting adjustments. Management has reiterated a 2025 revenue guidance between $157 million and $177 million and expects to achieve positive adjusted EBITDA by the end of 2025, indicating a strong focus on improving profitability metrics. The transition towards a subscription-based model and “Over-Time” revenue, projected to account for 90% of revenue by 2027, is expected to improve margins over the next few years.

SoundHound AI presents a compelling, albeit complex, investment opportunity. It is an early mover in the burgeoning conversational AI and agentic AI markets, targeting broad and growing addressable markets in automotive, restaurants, healthcare, and financial services. Its proprietary technology offers a distinct performance advantage, and its strategic acquisitions have significantly expanded its market reach and product diversification.

However, risks include persistent unprofitability, high valuation based on future growth, intense competition from well-capitalized tech giants, and potential integration challenges from recent acquisitions. The inherent volatility of the automotive sector, a key revenue driver, also warrants careful monitoring.

Conclusion: A Voice for the Future

SoundHound AI stands at the precipice of a transformative era in human-machine interaction. Its pioneering work in Speech-to-Meaning®, Deep Meaning Understanding®, and its aggressive push into voice-first generative and agentic AI position it as a critical infrastructure provider for industries seeking to harness the power of conversational intelligence. The strategic shift from a consumer app to a B2B enterprise focus, coupled with a robust acquisition strategy, has rapidly expanded its market footprint and diversified its revenue streams.

While the path to consistent profitability remains a key challenge and a critical area for investor scrutiny, SoundHound’s technological distinctiveness and its clear vision for the future of AI Agent Enterprise Applications are undeniable. As the world increasingly embraces voice as a primary interface for interacting with technology and commerce, SoundHound AI is not just participating in this shift; it is actively shaping its future, orchestrating a world where conversations with machines are as natural and intuitive as human dialogue. The company’s journey continues to be one of profound technological innovation and strategic evolution, making it a compelling entity to watch in the unfolding narrative of artificial intelligence.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Investors should conduct their own due diligence before making any financial decisions. We are not responsible for any investment losses incurred based on the information provided in this article.