IREN (Ticker: IREN) — From Bitcoin Miner to AI Infrastructure Powerhouse

Introduction: At the Crossroads of Crypto and AI

In the torrent of hype around AI and crypto, it’s easy to lose sight of the deeper structural stories. IREN (Ticker: IREN) is one such story – a company that started in the high-variance world of Bitcoin mining but is now pushing aggressively into AI compute infrastructure.

This article offers a comprehensive IREN stock analysis and narrative, covering IREN’s business model, its emerging moat, latest financials and updates, key risks, and how you might think about it as an investment play in 2025 and beyond.

Company Overview & Recent Highlights

IREN, formerly known as Iris Energy, rebranded in late 2024 to reflect its broader ambition beyond pure crypto mining.

It is a vertically integrated data center and compute infrastructure operator, with roots in Bitcoin mining. Its operations span Australia, Canada, and increasingly the U.S., with a growing footprint in high-power compute zones.

A few recent headline moves:

- In September 2025, IREN doubled its AI cloud capacity to ~23,000 GPUs and raised its AI cloud ARR (annual recurring revenue) target to over $500 million.

- The company also appointed Anthony Lewis as CFO in September 2025, signaling a scaling of financial leadership.

- In August 2025, IREN reported its full-year FY25 results, showing strong momentum in both mining and AI infrastructure.

These moves show that IREN is not waiting on “if AI happens”; it’s doubling down now.

Business Model & Strategic Pivot

To understand the IREN thesis, it’s essential to see how its two core businesses interplay: Bitcoin mining and AI / GPU cloud infrastructure.

Bitcoin Mining: The Cash Engine

Historically, Bitcoin mining has been IREN’s dominant revenue source. The company builds, operates, and scales mining farms, deploying ASIC miners and securing grid-power access to convert electricity into Bitcoins.

But unlike many miners that accumulate Bitcoin holdings, IREN follows a “sell-what-you-mine” approach, converting mined BTC into cash immediately. This gives it a stream of reinvestment capital with less exposure to Bitcoin price volatility. (This approach is often cited as a differentiator in commentary on IREN’s pivot.)

Because of its scale, infrastructure, and power rights, IREN has achieved relatively efficient mining operations, making it a cash-generating base to fund its next phase.

AI / GPU Cloud & Compute Infrastructure: The Growth Engine

The pivot ambition is to become a major player in AI compute infrastructure, offering GPU rental, colocation, build-to-suit data centers, and AI/cloud services. The idea: as AI adoption surges (large LLMs, model training, inference), demand for capable GPU clusters with efficient power and cooling will outpace current supply.

IREN’s innovation is to combine its mining-scale infrastructure (power, cooling, grid connectivity) with AI compute. Because it owns land, power access, and cooling systems, it can deploy GPU capacity more cost-effectively than peers who must lease or purchase each link of the chain.

In effect, IREN is evolving from a “Bitcoin miner that dabbled in AI” to a full compute infrastructure firm with deep roots in crypto power economics.

Inside IREN’s AI Reinvention: Five Insights Every Investor Should Knowive Surprising Facts

1. Their Tiny AI Business Has an Absolutely Massive Profit Margin

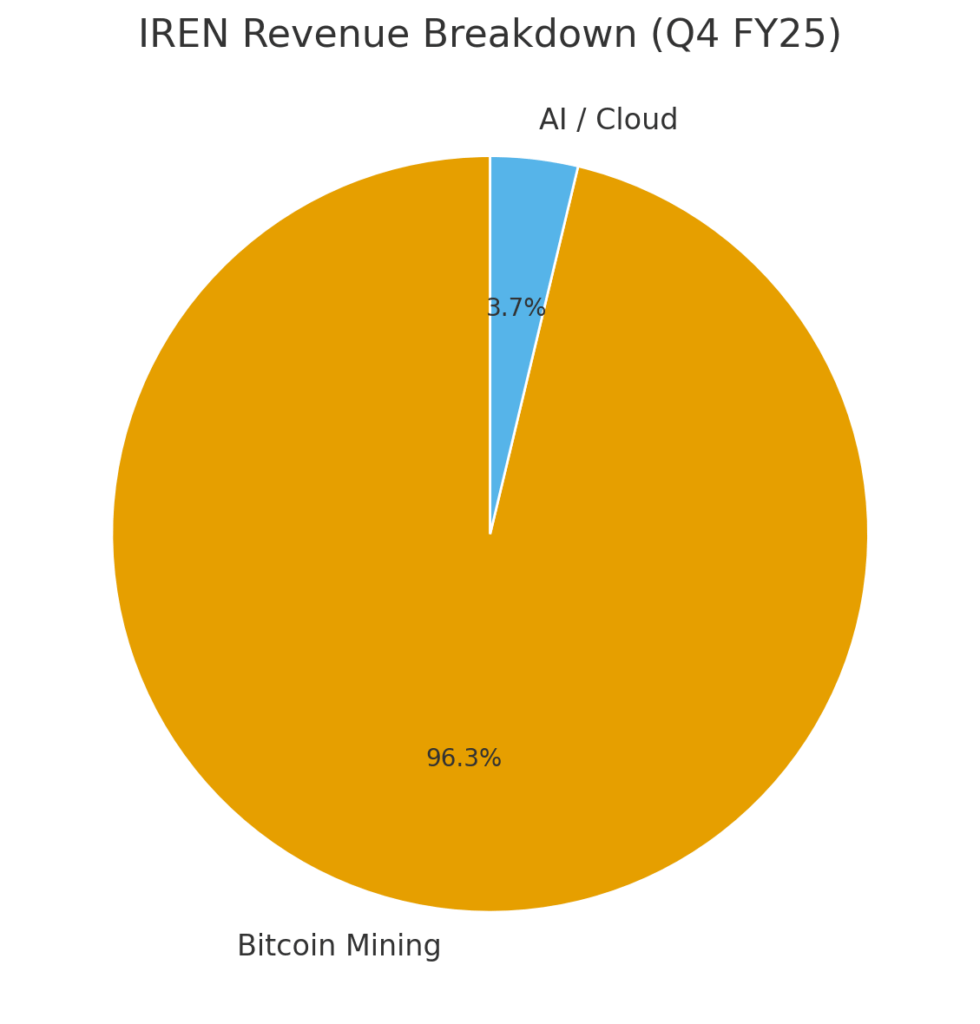

As of early 2025, the revenue mix remained heavily skewed to Bitcoin mining (e.g. in one month, ~$45.3 million from mining vs. ~$1.6 million from AI/cloud). But the margin story tells a different truth: the AI unit reportedly commands ~97% hardware margin, whereas mining yields ~76%.

In interviews and investor write-ups, IREN management has cited that margin gulf as a rationale to cap further mining expansion (e.g. ~52 EH/s max) in favor of faster allocation to AI infrastructure.

Recent results support this shift: the AI segment is expanding rapidly, with GPU fleet growth, deeper procurement, and improving contract traction. As that segment composes a more meaningful share of revenue, the blended margin of the company can rise dramatically.

2. They Aren’t Just Building Data Centers: They’re a “Super Landlord”

IREN’s vertical integration is a strategic advantage. It owns land, power substations, grid interconnections, cooling systems, and data halls, giving it control across the value chain. Unlike peers who lease space or power, IREN can optimize cost, speed, and deployment flexibility.

This foundation allows IREN to undercut peers on GPU rental pricing (e.g. offering up to 20% discounts in some comparisons) while sustaining margin. Plus, owning power and grid assets means less reliance on third-party contracts or lease escalations.

With ~3 GW of power capacity secured (with key assets like Sweetwater, Texas) and existing deployed capacity in the 800–1,000 MW range, IREN is positioning itself as a landlord to AI workloads.

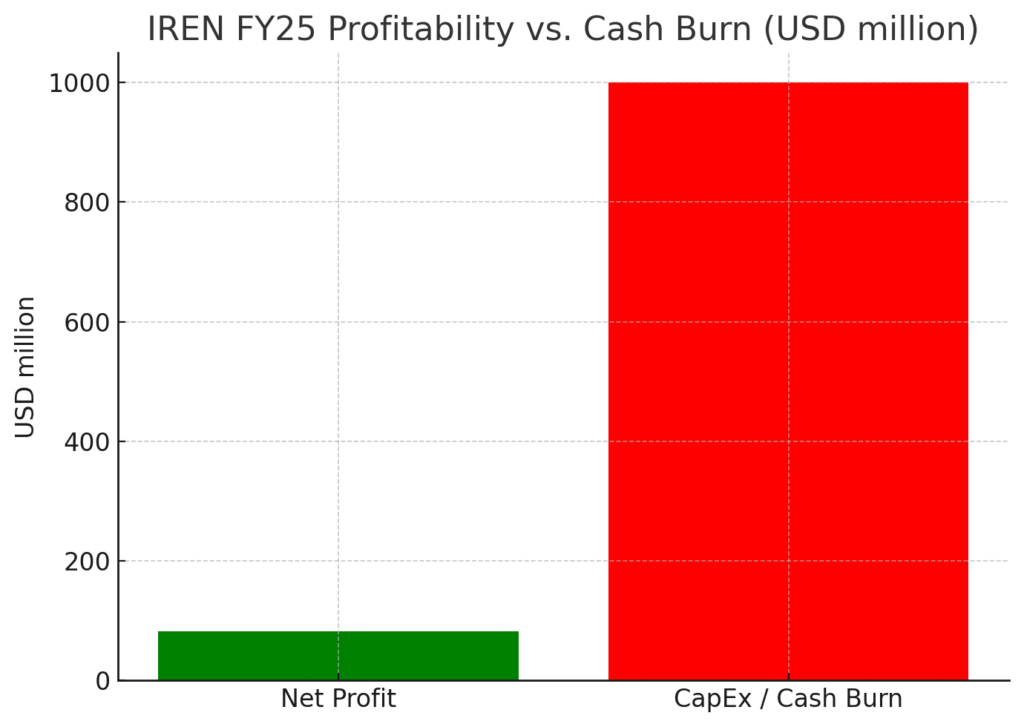

3. They’re Reporting Record Profits While Burning a Billion Dollars a Year

This paradox encapsulates the tension in IREN’s strategy. In FY25, the company posted record revenue and blew past expectations, with accelerating EBITDA growth. For example, many news outlets report IREN posted Q4 FY25 revenue of $187.3 million, while net earnings rebounded to positive territory.

Yet, beneath that surface lies huge capital deployment, over $1 billion of cash burn is not unusual for a rapidly scaling infrastructure play. The negative free cash flow is largely due to GPU purchases, facility buildouts, and grid / power infrastructure development.

To plug the capital gap, IREN has issued equity (leading to dilution), raised debt, and leaned on its mining cash flows. The textbook “scale-first, monetize-later” model is not for the faint of heart.

4. Their Bitcoin Strategy Is Surprisingly “Un-Crypto”

In an industry where many miners hold onto Bitcoin reserves as a speculative bet, IREN takes the opposite tack. It immediately sells mined Bitcoin to convert its mining operations into a consistent cash factory. This reduces balance-sheet exposure to BTC price swings and aligns incentives toward real infrastructure growth.

CEO Dan Roberts has made it clear: once a 50 EH/s mining base is achieved, the focus shifts squarely onto high-density infrastructure for AI and HPC workloads.

This positioning makes IREN less a crypto “bet” and more an infrastructure growth play.

5. They’re Building for an AI Future That Hasn’t Arrived Yet

IREN’s capital investments show that this is not a race to build “generic data centers,” but a bet on the next-generation thermal and compute demands. The company is adopting direct-to-chip liquid cooling (and planning for it in flagship builds like “Horizon 1”), anticipating hotter, more power-dense GPUs in future AI hardware (e.g. NVIDIA’s Blackwell or GB200 families).

Because high-end AI chips generate significant thermal loads, air-cooling will struggle as density increases. By integrating liquid cooling from day one, IREN positions itself to host premium AI workloads with high utilization and lower cooling overhead.

Financials & Key Metrics (Latest Data)

Let’s layer in the most recent public results and key metrics to ground the narrative.

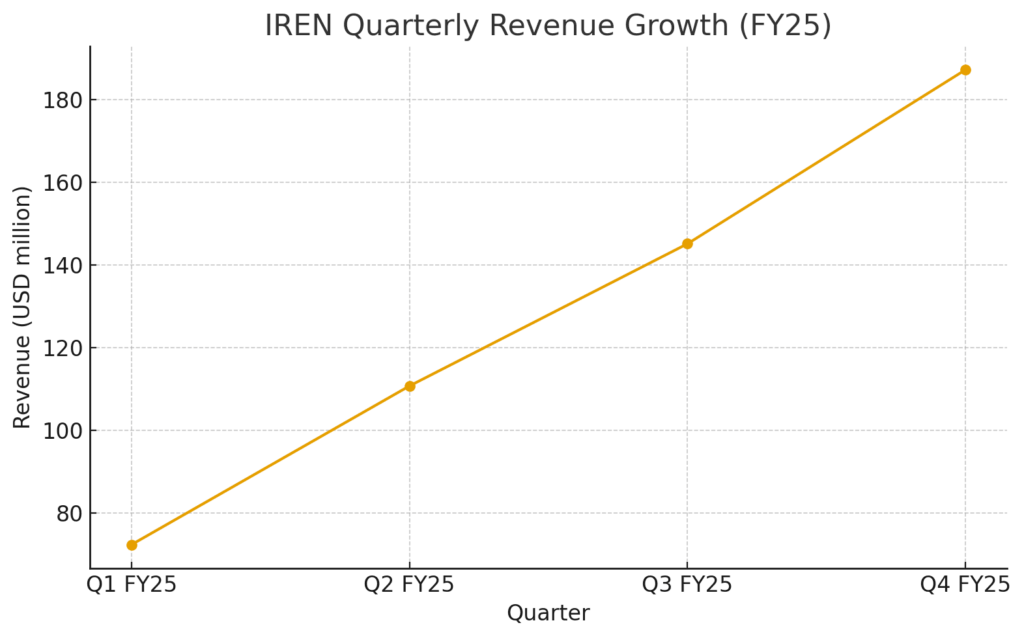

Q4 FY25 & Full-Year Highlights

- In Q4 FY25, IREN reported $187.3 million in revenue, a ~228% increase year-on-year.

- The company turned a net profit: ~$0.70 per share vs. a loss a year ago.

- Bitcoin mining revenue grew ~233% to $180.3 million, supported by deployment of ~50 EH/s of hashing power.

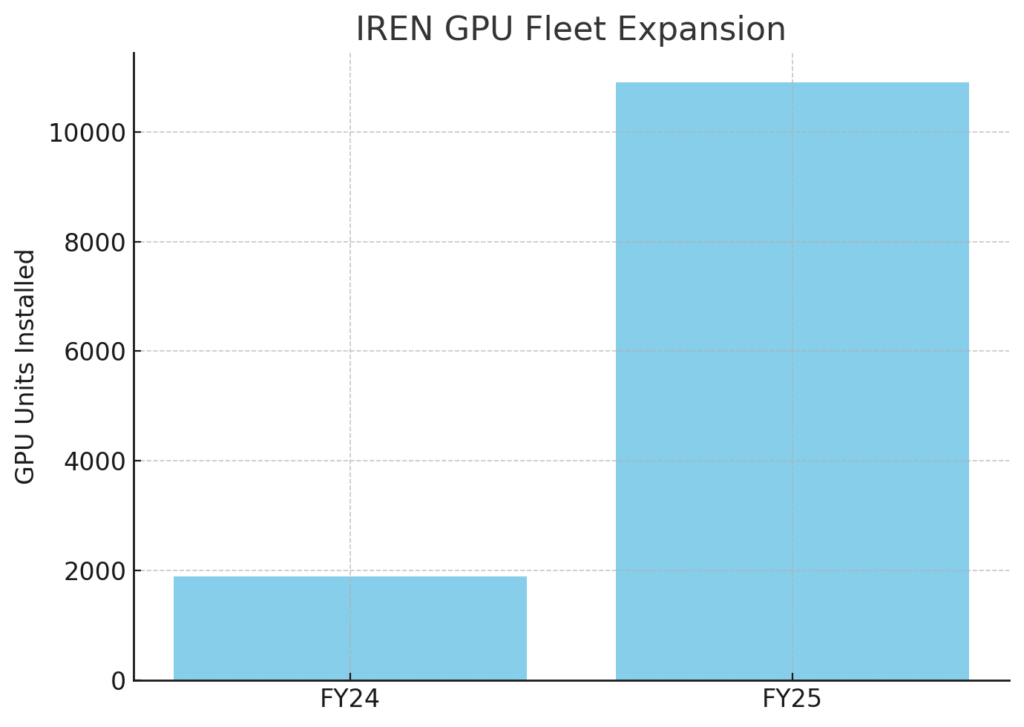

- AI cloud capacity expanded by ~132% during the year, with GPU count rising to ~1,900 installed GPUs.

- IREN purchased an additional 1,200 air-cooled B300 GPUs and 1,200 liquid-cooled GB300s (spend ~$168 million), boosting fleet to ~10,900 GPUs.

- The company also secured NVIDIA “Preferred Partner” status — enhancing procurement access and client pipeline.

- On revenue mix: cryptocurrency / mining still contributed ~96% of consolidated revenues.

These numbers show both momentum and transition; the mining business is scaling, but AI infrastructure is being aggressively layered.

Valuation & Market Metrics

- IREN’s trailing P/E is extremely high (~120×) per StockAnalysis.

- Its forward P/E (when factoring growth expectations) falls to ~47×.

- The 12-month analysts’ consensus target is ~$42.63, implying a ~9% downside from current prices.

- Market cap is ~$12.8 billion (per Simply Wall St) with shares ~271.98 million outstanding.

- IREN has a very high beta (reported ~4.2) — meaning high volatility relative to the broader market.

- The 52-week trading range is extreme: a low of ~$5.13 to a high near ~$49.39.

These metrics reflect a stock that’s already had a parabolic move and contracts any misstep will be magnified.

Insider & Ownership Activity

- In recent months, both Co-CEOs, Daniel John Roberts and William Gregory Roberts, sold 1,000,000 shares each (estimated ~$33.1 million).

- Institutional flows: in Q2 2025, some major funds added exposure (e.g. FMR LLC), while others pared back positions.

Significant insider selling can raise questions about confidence, even in a high-growth company, though it might also reflect liquidity needs or diversification.

Moat, Differentiation & Competitive Landscape

To assess whether IREN’s trajectory is sustainable, we must examine its moat and the competitive threats it faces.

Sources of Moat

- Full-stack Infrastructure Ownership

Owning land, grid interconnects, cooling systems, and data halls gives IREN cost and deployment flexibility that pure “tenant” models lack.

- Early-Scale GPU Commitment & Supply Relationships

By locking in GPU supply early (e.g. tens of thousands of units) and achieving NVIDIA preferred partner status, IREN positions itself ahead of many rivals in securing capacity and favorable terms. - Thermal / Cooling Innovation (Liquid Cooling)

Investing in liquid cooling and high-density compute readiness from the start offers a technical edge for hosting demanding AI workloads.

4. Mining-Driven Capital Recycling

The existing mining business gives IREN a built-in capital engine that can be reallocated to power expansion, reducing dependency on external funding sources.

5. Narrative & First-Mover Perception

As one of the earlier miners to credibly pivot into AI infrastructure at scale, IREN captures investor imagination and narrative premium.

Competitive & Execution Risks

- Hyperscaler Competition

Giants like AWS, Microsoft, Google, CoreWeave, and others can deploy capital more aggressively, absorb losses, or bundle services. If they decide to compete directly in GPU rental, margins could compress. - GPU / Hardware Supply or Obsolescence Risk

If supply chains get constrained, or new architectures require retooling, IREN’s deployment plans may be delayed or require re-investment. - Power, Grid & Regulatory Risk

Execution around grid reliability, energy cost fluctuations, regulatory or permitting changes in key locations are critical risk vectors in energy-intensive infrastructure. - Dilution & Capital Pressure

Continued capital raises will further dilute shareholders. If the AI segment fails to generate free cash flow quickly enough, funding pressure builds. - Macro / Crypto Volatility

Sharp Bitcoin price drops or regulatory shifts around crypto could erode IREN’s mining base and financial cushion. - Margin Compression Over Time

Ultra-high margins (e.g. 97%) may not persist as scale brings competition, overheads, and price pressures.

Investment Thesis & Strategy

How should an informed investor incorporate IREN into a portfolio? Here is a framing:

Opportunity (Bull Case)

- The AI infrastructure wave is just beginning; demand for GPU compute will outstrip supply for years.

- IREN’s cost advantage, vertical integration, and early GPU bet position it to capture a disproportionate share of that demand.

- If the AI segment achieves scale and positive free cash flow, re-rating is possible, from a speculative high-growth multiple to a more sustainable infra multiple.

- The risk is asymmetric: much upside if execution works, possibly harsh downside if it doesn’t.

Risks (Bear Case)

- Delays or failures in execution could turn capital burn into financial trouble.

- A downturn in crypto or macro risk could remove IREN’s cash cushion.

- Hyperscaler entrants or GPU supply disruptions could compress margins or hinder growth.

Positioning & Entry Strategy

- Treat IREN as a high-volatility, high-optional-return growth position, not a core stable pick.

- Use staggered entries, don’t commit the full allocation at once, given the valuation and volatility.

- Monitor key catalysts: AI revenue inflection, GPU scale, client contract announcements, margin expansion, and dilution announcements.

- Be prepared to act if sentiment turns or if valuation multiples contract.

Conclusion & Outlook

IREN is executing one of the boldest cross-domain pivots in the tech/infra space today. What began as a high-efficiency Bitcoin miner is evolving into a compute infrastructure firm betting on AI’s insatiable demand.

The five surprising facts we explored (margin differentials, “super landlord” model, paradoxical profitability vs. cash burn, non-speculative mining strategy, and readiness for next-gen AI hardware) are not gimmicks, they are the pillars of IREN’s evolving strategy.

However, this is a high-wire act. Success demands flawless execution, favorable macro tailwinds, and durable margins in the face of competition.

For forward-looking investors, IREN is not a safe yield play: it is a levered call option on AI infrastructure. If you believe the compute arms race is real, and that infrastructure rather than software will become the bottleneck, IREN is among the most interesting plays to track.