Palantir (PLTR) Exposed: Is This Controversial AI Stock a Buy, Sell, or Hold?

The Palantir Paradox: High Valuation, Higher Potential – Should this AI Powerhouse Palantir (PLTR) Be in Your Portfolio?

In the rapidly evolving landscape of artificial intelligence, a select few companies stand poised to redefine industries and national capabilities. Among them, Palantir Technologies (PLTR) has emerged as a particularly intriguing, and often debated, player. Far from being just another “big data” company, Palantir has carved out a unique niche by building sophisticated AI-powered solutions that tackle some of the world’s most complex data challenges. But is this pioneering spirit enough to warrant a significant investment in your portfolio?

This article will delve deep into Palantir’s core technology, its strategic competitive advantages, its recent financial performance, and the inherent risks and opportunities that define its investment potential. By demystifying its offerings and evaluating its position in the burgeoning AI application space, we aim to provide a comprehensive guide for financial and investment blog readers like you, helping you determine whether Palantir is indeed a strong AI investment for the long haul.

The Core Technology Behind Palantir: Fueling Decisions with Data and AI

To truly understand Palantir, we must move beyond the buzzwords and grasp the essence of its innovative platforms: Foundry and the Artificial Intelligence Platform (AIP). These aren’t just software; they are sophisticated operating systems designed to transform raw, disparate data into actionable intelligence, forming the backbone of informed decision-making for enterprises and governments alike.

How Palantir Makes Money: A Dual-Engine Approach

Palantir’s revenue generation is driven by its sales of these powerful data-mining and analytics platforms to a diverse client base, primarily segmented into two key areas:

Government & Defense

Government & Defense: Historically, Palantir’s stronghold has been in securing lucrative, long-term contracts with government and intelligence agencies in the U.S. and allied nations. Its Gotham platform is instrumental in national security, counterterrorism, and military operations, allowing users to analyze vast datasets for critical insights. This segment provides a stable and often classified revenue stream, with applications ranging from mission planning and logistics optimization for the U.S. Department of Defense to assisting in critical events like the COVID-19 pandemic response for the U.K. National Health Service (NHS).

Commercial Sector

Commercial Sector: While government contracts remain a significant portion, Palantir has been aggressively expanding its footprint in the commercial sector. Its Foundry platform is gaining considerable traction among large enterprises across industries like manufacturing, energy, finance, and healthcare. Here, Palantir helps businesses optimize operations, perform predictive analysis, and gain competitive advantages through superior data utilization. This expansion is a key growth driver, with U.S. commercial revenue showing remarkable acceleration in recent periods.

Palantir’s business model involves a unique “acquire, expand, and scale” approach. Initially, they might offer system implementation at a low cost or even free to acquire a client. Once embedded, they expand the implementation to address broader challenges, ultimately enabling clients to integrate Palantir’s software extensively within their operations.

Foundry: The Ontology-Powered Operating System

At its heart, Foundry is described as “the ontology-powered operating system for the modern enterprise.” This isn’t just about collecting data; it’s about organizing and understanding it in a way that mimics human knowledge. Ontology, in this context, is a formalized knowledge representation, like a domain-specific dictionary or encyclopedia, that allows computers to comprehend concepts, relationships, and hierarchies within specific data sets.

The power of Foundry lies in its ability to:

- Integrate Disparate Data: It connects various data modules and models, creating a coherent, structured understanding of an organization’s entire data landscape.

- Enable Advanced Analytics and Workflows: By building a connected data structure, Foundry facilitates sophisticated analysis, automates operational workflows, and empowers more effective decision-making.

- Foster an Ecosystem: Similar to major tech platforms, Foundry boasts its own marketplace, fostering an ecosystem where third-party developers, enterprises, and Palantir collaborate, enriching the platform’s capabilities.

The critical advantage of Foundry’s ontology-based design is its inherent ability to facilitate AI agent functionality.

Artificial Intelligence Platform (AIP): Democratizing AI Power

The AI Platform (AIP) is not a standalone product but rather a powerful “plugin based on Foundry.” Introduced in early 2023, AIP significantly lowers the barrier for non-technical users to leverage the full suite of Palantir’s tools and external large language models (LLMs) like GPT-4.

Key features and advantages of AIP include:

- AI Agents: Leveraging the ontology structure, AIP enables the creation of highly effective AI agents that can automate complex tasks and make intelligent decisions. Examples include:

- Trinity Rail: AI agents streamlined supplier and SKU management, automated email responses, summarized delivery times, and flagged underperforming suppliers, drastically improving efficiency.

- Heineken Supply Chain: Agents like “Accelerate Orders Before Out of Stock (ABU)” and “Doctor Dre” automate and optimize supply chain operations, prioritizing orders for low-stock items, managing container demurrage costs, and dynamically rerouting shipments, reducing human intervention.

- Plexel (Clinical Trial Data): AI agents automate the laborious process of annotating clinical trial data, generating required documentation, and performing data mapping and validation, significantly cutting down time and costs.

- Visualization and Low-Code/No-Code Interfaces: AIP empowers “powerful visualization and low-code/no-code” capabilities. This means:

- Clients don’t need extensive teams of software or data engineers for project implementation.

- Non-technical personnel can perform complex technical operations through intuitive visual interfaces and natural language interaction (akin to conversing with ChatGPT). This fundamentally democratizes access to advanced data analytics and AI.

This combination of Foundry’s robust data integration and AIP’s accessible AI capabilities allows Palantir to offer deeply customized and tailored data application services, differentiating it from generic SaaS systems. Palantir argues that this deep customization, often perceived as a weakness by some, is actually a strength because “data applications cannot be made generic” given the unique nature of each company’s data. Palantir’s ability to rapidly provide customized products and integrate all data requirements end-to-end allows them to build comprehensive “enterprise data ecosystems” for clients, creating significant stickiness and dependency.

Furthermore, Palantir can even provide a complete “enterprise operating system,” encompassing various functions from HR to logistics, allowing clients to bypass traditional ERP and SaaS systems and transition directly to Palantir’s AI-centric model, as demonstrated by the European Cricket Network’s successful adoption.

Palantir’s Competitive Moat: An Unassailable Fortress?

In the cutthroat world of technology, a strong competitive moat is paramount for sustainable growth. Palantir, with its unique blend of technology, strategic partnerships, and operational philosophy, has built several formidable barriers to entry.

- Proprietary Data Integration and AI Models (Ontology-Based Foundation): Palantir’s core strength lies in its ontology-based data integration. This isn’t merely about collecting data; it’s about creating a living, evolving “knowledge graph” that understands the relationships and contexts within an organization’s data. This foundational capability allows for the effective deployment of AI agents and distinguishes Palantir from competitors that offer more generic data solutions. The deep customization and integration into client operations make it incredibly difficult for rivals to replicate.

- Regulatory Expertise and Compliance in the Defense Industry: Palantir’s long-standing relationships and deep integration with government and defense agencies provide a significant advantage. The highly sensitive and regulated nature of this sector means that building trust and achieving the necessary security clearances and compliance is a monumental task for new entrants. Palantir’s established track record and proprietary Gotham platform, specifically designed for these environments, create a de facto barrier.

- The “Software + Services” Hybrid Model: Unlike pure software vendors or traditional consulting firms, Palantir employs “forward-deployed engineers” who embed themselves within client organizations. This hybrid approach ensures successful implementation and ongoing value extraction, especially for government clients who may lack the internal technical talent to fully leverage modern software. This deep involvement creates extreme stickiness, as Palantir maps a client’s entire data corpus to its proprietary “ontology,” making it challenging to switch providers.

- Dual Government and Commercial Business: Operating effectively in both highly distinct sectors is a unique advantage. While competitors might focus on one, Palantir leverages its government-honed security and data handling expertise to win commercial contracts, and conversely, its commercial innovations can be adapted for government use.21 This dual engine provides diversification and broadens its market reach, with no direct competitor possessing the same breadth and depth across both domains.

- Results-Oriented Company Culture: Palantir is known for its aggressive, results-driven, and customer-focused culture. This enables rapid deployment of solutions and quick demonstration of value, a critical factor in complex enterprise and government environments where tangible outcomes are highly prized.

- Lowered R&D Costs through AI: Palantir practices what it preaches. By leveraging its own AI capabilities, the company can potentially reduce its internal R&D expenses, allowing for business expansion without a proportional increase in employee count, further improving efficiency and profitability.

How it Compares to Competitors like Google, IBM, Microsoft, and Lockheed Martin (LMT)

While tech giants like Google, IBM, and Microsoft certainly offer strong AI and cloud capabilities, they typically operate on a different scale and focus.

- Google Cloud and Microsoft Azure: These companies provide broad cloud infrastructure and a suite of AI/ML tools. While powerful, their offerings often require significant in-house technical expertise from clients to integrate and customize for highly specific operational workflows. Palantir, with its ontology-driven platforms and embedded engineers, offers a more tailored, end-to-end solution that effectively becomes an operating system for the client’s data.

- IBM: IBM has a long history in enterprise software and AI (e.g., Watson). However, Palantir’s focus on deep data integration through ontology and its agile, results-driven deployment contrast with some of the broader, more generalized offerings from IBM.

- Lockheed Martin (LMT): As a defense prime, Lockheed Martin is a customer of AI solutions rather than a direct competitor in the software platform space. They leverage AI within their defense systems and may partner with companies like Google Cloud to build out their AI capabilities, highlighting the collaborative rather than directly competitive nature.

In essence, while others provide the tools and infrastructure, Palantir aims to be the architect and builder of the entire data-driven decision-making engine, particularly for complex, sensitive, and high-stakes environments.

Financial Performance & Investment Potential: Gauging PLTR’s Trajectory

Understanding Palantir’s financial health and market position is crucial for any potential investor. The company has shown significant positive trends recently, although its valuation remains a hot topic of debate.

Revenue Growth & Funding History

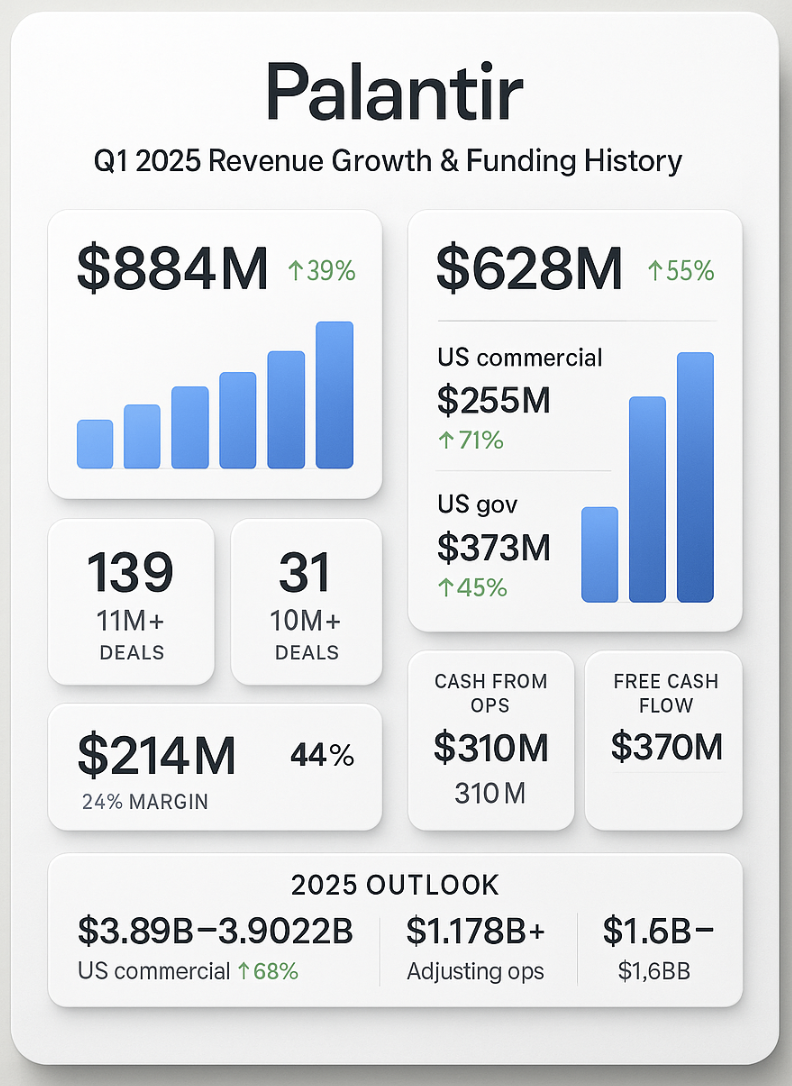

Palantir’s financial performance has been on an upward trajectory. Quarterly revenue has accelerated, particularly from 2023 to 2025.

- Recent Performance (Q1 2025 Highlights):

- Total revenue grew 39% year-over-year to $884 million.

- U.S. revenue surged 55% year-over-year to $628 million.

- U.S. commercial revenue was a standout, growing 71% year-over-year to $255 million, indicating strong private-sector adoption.

- U.S. government revenue grew 45% year-over-year to $373 million.

- The company closed 139 deals of at least $1 million, with 31 deals exceeding $10 million, showcasing its ability to secure large-value contracts.

- Achieved GAAP net income of $214 million, representing a 24% margin, and an adjusted operating margin of 44%.

- Cash from operations reached $310 million, and adjusted free cash flow was $370 million.

- Outlook for 2025: Palantir has raised its full-year 2025 revenue guidance to $3.890 – $3.902 billion, implying a growth rate of approximately 36% year-over-year. U.S. commercial revenue guidance is now in excess of $1.178 billion, representing at least 68% growth. The company also projects adjusted income from operations between $1.711 – $1.723 billion and adjusted free cash flow between $1.6 – $1.8 billion.

This accelerating revenue growth and improved profitability, particularly the “V-shaped rebound” in adjusted operating margin and year-on-year revenue growth (as indicated by an impressive Rule of 40 score of 83% in Q1 2025), is largely attributed to the maturation of LLMs and the successful introduction of AIP in early 2023.

Palantir has also garnered significant backing from institutional investors throughout its history, a testament to its disruptive potential and the confidence placed in its leadership and technology.

Market Valuation & Future Growth Potential

Despite strong growth and profitability, Palantir’s valuation remains a key point of discussion for investors. As of May 2025, Palantir’s market capitalization stands at approximately $298 billion. While its growth and profitability metrics are often rated highly by analysts (e.g., Seeking Alpha giving “A” for growth and profitability), its valuation, with a price-to-sales (P/S) ratio that has exceeded 70-100 and a forward P/E ratio over 200, is often cited as “F” or “very expensive.” This implies that significant future growth is already priced into the stock.

Total Addressable Market (TAM) for AI-Driven Application/Solutions: The global AI software market is projected for explosive growth. Roots Analysis anticipates the AI software market to generate a staggering $5.2 trillion in annual revenue by 2035, growing at a compound annual growth rate (CAGR) of almost 31% for generative AI software. Palantir, recognized by multiple third-party research agencies as a top vendor of AI software platforms, is well-positioned to capture a substantial share of this massive market. Its ability to win larger deals ($1 million and $5 million+ deals increasing significantly) and expand existing contracts further validates its market penetration potential.

Growth Projections based on Industry Trends: The increasing complexity of global data, the ongoing digital transformation across industries, and the accelerating adoption of AI across various sectors (from defense to healthcare and manufacturing) all serve as powerful tailwinds for Palantir. The company’s unique ability to rapidly deploy AI solutions and integrate them into complex operational workflows makes it an attractive partner for organizations grappling with these challenges. Its growing U.S. commercial business, with over 70% year-over-year growth in Q1 2025, signals a successful expansion beyond its traditional government base.

Risks & Challenges

Investing in Palantir, despite its potential, comes with inherent risks:

- Regulatory and Data Privacy Concerns: Palantir’s work with government and intelligence agencies has historically raised concerns about data privacy and ethical implications. While the company maintains strict protocols and adherence to legal frameworks, public sentiment and evolving regulations around data usage could pose challenges.

- Competition from Tech Giants: While Palantir maintains a unique moat, it operates in a competitive landscape. As Google, Microsoft, and Amazon continue to enhance their enterprise AI and cloud offerings, they could become more direct competitors, especially in less specialized commercial segments.

- Scalability and Profitability Challenges: Despite recent profitability, maintaining high growth rates and expanding margins as the company scales will be a continuous challenge. The high cost of its specialized solutions might limit its market to larger enterprises and governments, potentially hindering rapid expansion into the broader SME market without significant changes to its business model.

- High Valuation: As discussed, the current valuation is exceptionally high. This means that even minor misses in earnings or guidance could lead to significant stock price volatility and corrections. Investors are essentially paying a premium for future growth, and any slowdown could be heavily penalized.

- Customer Concentration (Historical): While Palantir is diversifying, its historical reliance on large government contracts could expose it to risks associated with contract renewals, government budget cycles, and geopolitical shifts.

Analyst and Market Sentiment

Analyst sentiment on Palantir is somewhat polarized. While many acknowledge its strong technological foundation and growth potential, the lofty valuation leads to a wide range of price targets and recommendations. Some analysts rate it as a “hold” or even “sell” due to valuation concerns, while others maintain “buy” ratings, emphasizing its long-term growth prospects in the AI market. The stock’s high beta characteristics mean it’s particularly responsive to both company-specific news and broader market trends, leading to significant volatility.

The potential for acquisition by a larger firm is always a speculative possibility for high-growth tech companies. However, given Palantir’s unique position, sensitive government contracts, and the strong vision of its leadership, an acquisition seems less likely in the near term compared to a strategic partnership.

Conclusion: Is Palantir (PLTR) a Strong AI Investment?

Palantir Technologies stands at the forefront of the AI application revolution, offering sophisticated solutions that transform complex data into actionable intelligence for both governments and commercial enterprises. Its core strengths lie in its ontology-based Foundry platform, the highly accessible Artificial Intelligence Platform (AIP), and its formidable competitive moats, including deep data integration, regulatory expertise, a unique “software + services” model, and a dual-sector business approach.

Recent financial performance underscores its accelerating revenue growth, particularly in the U.S. commercial sector, and a commendable return to GAAP profitability. The company is actively expanding its customer base and securing larger deals, signaling strong traction in a rapidly expanding total addressable market for AI software.

However, the investment landscape for Palantir is not without its caveats. The stock trades at a premium valuation, with high price-to-sales and price-to-earnings ratios, meaning significant future growth is already priced in. This high valuation, coupled with potential regulatory scrutiny and competition from tech giants, introduces considerable risk and volatility.

Who should consider investing?

- Long-Term Growth Investors: Those with a high-risk tolerance and a long-term investment horizon who believe in the transformative power of AI and Palantir’s unique position within this space. These investors are willing to ride out short-term volatility in anticipation of significant future market capture.

- Conviction-Based Investors: Investors who have thoroughly researched Palantir’s technology, business model, and competitive advantages and hold a strong conviction in its ability to execute on its vision and continue to innovate in the AI domain.

- Investors Seeking AI Exposure: Those looking for direct exposure to a pure-play AI application company that is already deeply embedded in critical government and enterprise workflows.

Final Thoughts and Investment Takeaways:

Palantir is not for the faint of heart. Its current valuation demands exceptional execution and continued high growth rates. However, its innovative technology, demonstrated ability to deliver tangible value to a diverse and critical client base, and the sheer size of the AI software market offer a compelling long-term narrative.

For those who believe that data is the new oil and that truly understanding and leveraging it is the key to future success, Palantir presents a unique, albeit expensive, opportunity. A dollar-cost averaging strategy might be a prudent approach for investors looking to build a position over time, mitigating some of the risks associated with its current high valuation. Ultimately, whether Palantir (PLTR) earns a spot in your portfolio depends on your individual risk appetite, investment horizon, and conviction in its ability to unlock tomorrow’s insights and become a cornerstone of the AI-powered future.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Investors should conduct their own due diligence before making any financial decisions. We are not responsible for any investment losses incurred based on the information provided in this article.